Link to this. A hire purchase agreement is a type of leasing contract in which the lessee gets control of the asset during the agreed term.

The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense.

. Well take a look at an example using a hire purchase contract that illustrates this theory. They are the supply of goods and the supply of financial service instalment credit finance. Here is the video about How to calculate Interest on Hire Purchase system In this video we have discussed basics concepts of Hire purchase system in account.

While simple interest does not take this into account. Total Payment RM. This hire purchase calculator will show the principal and interest costs per month to show the level of extra payments on top of the items price that you will be paying as well as the size of the monthly principal payments.

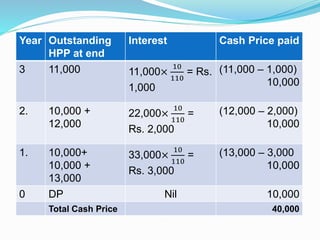

During this period they provide the lessor with several payments which include interest and principal amounts. The double entry will be. Original Loan Amount x Number of Years x Interest Rate Per Annum Number of Instalments Interest Payable Per Instalment.

The more repayments there are the closer it is to double the flat rate. The monthly payments comprising capital and interest are 685 per month and there is an option to purchase fee payable at the end of the lease term of 150 which is included in the final payment. In essence the lessee hires these assets and uses them during a specific period.

It is popularly used in personal loans and hire purchase car loans. Hire purchase and simple interest short answers ID. Interest Rate pa.

S Starting amount after deposit has been subtracted no interest i Interest rate divide the by 100 and then again by 12 4 or 6 depending on the number of times interest will be calculated n number of time periods that the purchase. Most hire purchase deals are done over 36. Assuming you are buying a car that cost RM100000.

Hire purchase is calculated using the simple interest formula and interest is only calculated on the amount owing. Debit Hire Purchase Creditor account Balance Sheet. Ownership of the goods is transferred when the last instalment is paid.

Say for example youre taking out a personal loan of RM100000 with a flat rate interest of 55 over 10 years. HIRE PURCHASE FORMULAS TOTAL AMOUNT PAID DEPOSIT INSTALMENTS TOTAL INTEREST PAID TOTAL AMOUNT PAID ORIGINAL PRICE OF ITEM The interest rate being charged under a Hire Purchase Agreement is calculated using the SIMPLE INTEREST formula and is called the ANNUAL FLAT RATE of interest. Many car finance companies have one on their websites and you can simply adjust the factors like your deposit amount and repayment term to know the estimated cost of financing a car.

If the hire purchaser becomes defaulter the hire vendor has the right to take away the goods and forfeit the instalments received as hire charges for the use of goods. Cr Hire purchase creditor - Access Credit Pte Ltd 2400000. Assuming the monthly repayment is 63500 of which 28900 is the HP interest and HP Principal repayment is 34600.

Dr Hire purchase creditor - Access Credit Pte Ltd 120000. You pay a 10 downpayment which is RM10000 and apply for an RM90000 loan. When a financier enters into a hire purchase agreement with a hirer the financier makes two supplies to the hirer for GST purposes.

The easiest and fastest way how to calculate interest rate on Hire Purchase is by using a car finance calculator. Hire purchase Other contents. As a general rule the price of a Hire Purchase is calculated as follows.

Dr Hire purchase interest in suspense 240000. Of instalments over the life of the contract annual flat rate of interest charged in contract The effective rate of interest is roughly about twice the flat rate of interest. Calculate the interest on the amount you are borrowing Divide the interest by the total number of.

Calculating the hire purchase loan. If you do not know your interest rate enter your monthly payment and we can. We will calculate your payments total costs total interest charged and provide a schedule of payments detailing each month of the contract to show you the remaining balance at each payment.

5 years 60 months or installments The total interest rate you will. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The interest rate that the bank offers you is 3 for 5 years.

Hire Purchase Add to my workbooks 18 Download file pdf Embed in my website or blog Add to Google Classroom Add to Microsoft Teams Share through Whatsapp. The monthly payment over 3 years is. 100 f I r Pt Where.

C Down payment Payment at the beginning of deal of hire purchase. Example Dealing with a finance lease for a lessee. Hiring Period in Years Calculated Interest Charges RM.

HP Interest in Suspense. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Hire Purchase System - Features Under the hire purchase system goods are sold on instalment basis.

Amount financed Total interest on amount financed Repayment period months RM50000 RM25000 60 RM75000 60 RM1250 Since term charges are calculated on the initial amount financed you will get a rebate on the term charges if you repay in full the balance due under the hire purchase HP agreement. Use our HP Hire Purchase calculator to get a full breakdown of your HP deal. B Hire price cash price interest for risk of giving asset on instalment.

Dr Fixed Asset - Plant Machinery 2160000. This hire purchase calculator will allow you to see the true cost of your hire purchase over the lifetime of the contract. A Cash price is that price which will be paid if any asset is purchased on cash without installment.

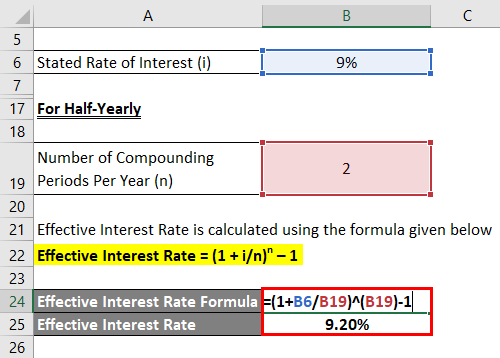

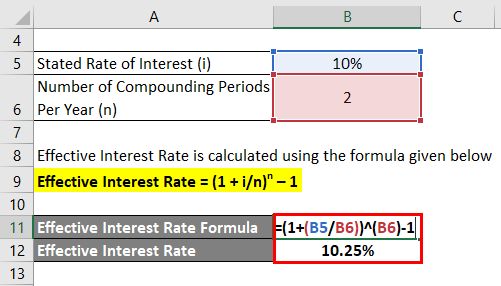

A and company ABC have made the hire purchase agreement of the car. EFFECTIVE RATE OF INTEREST FORMULA where n no. In the account tab of the Payment transaction.

1st instalment at payment module.

1 Hire Purchase System Calculation Of Interest Introduction With Solved Problem Kauserwise Youtube

The Ultimate Guide To Your Real Estate Social Media Marketing Strategy Plus 1 Real Estate Infographic Real Estate Agent Marketing Real Estate Marketing Design

Effective Interest Rate Formula Calculator With Excel Template

Difference Between Hire Purchase Vs Installment Purchase System Hire Purchase Accounting And Finance Learn Accounting

Long Term Debt Ratio Calculator Debt Ratio Debt Financial Management

How To Calculate Interest 4 Cases Hire Purchase

What Is A Sellers Market Nyc Hauseit Marketing Real Estate Marketing Investing

What Is A Principal Interest Payment Bdc Ca

Hire Purchase Accounting Interest Calculation Youtube

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Effective Interest Rate Formula Calculator With Excel Template

97 Real Estate Infographics How To Make Your Own Go Viral Real Estate Infographic Home Buying Process Home Loans

Hire Purchase System Calculation Of Interest

Effective Interest Rate Formula Calculator With Excel Template

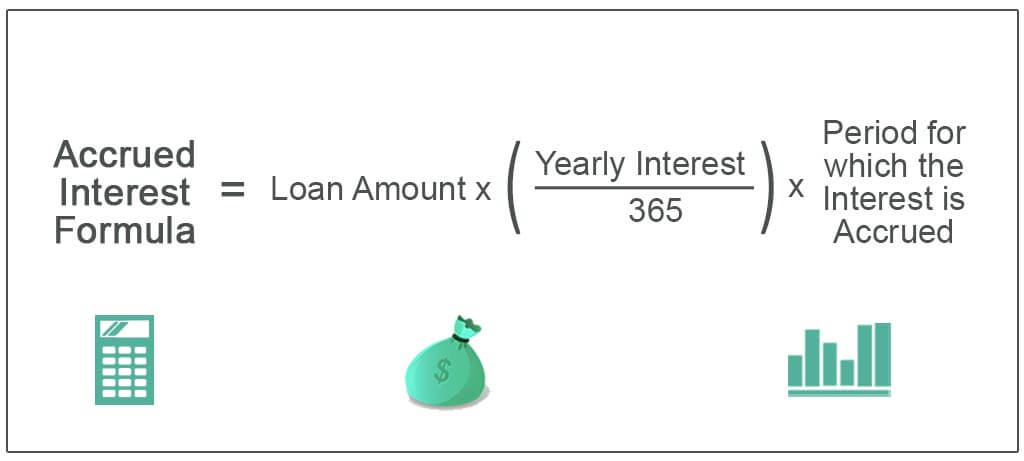

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest